This blog is now archived

This blog is now archived

Please note that this blog has been archived and is no longer being updated.

Please note that this blog has been archived and is no longer being updated.

Pensions Latest is currently being reviewed.

Today (30 June) marks two years since the Right to Request Flexible Working was extended to all employees who have worked for the same employer for at least 26 weeks. Many older workers are combining employment with caring for older …

We want to make sure that the Armed Forces and their families receive fair treatment from the nation which they serve, as set out in the Armed Forces Covenant. As well as the new State Pension, this year has also seen the launch of a new National Insurance credit designed to help Armed Forces spouses …

Is starting up a new business just for young people? As more people start up a business or become self-employed later in life, this is the age of the ‘olderpreneur’.

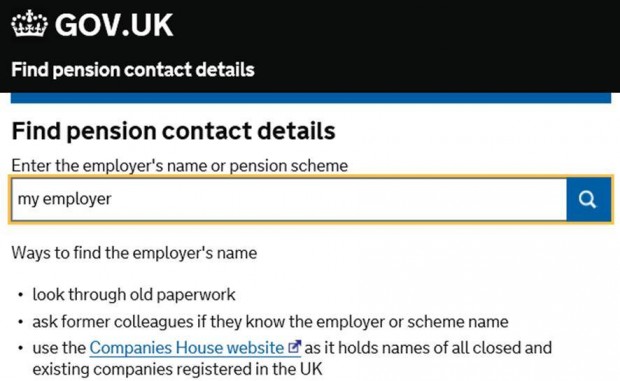

This week, we’ve launched a new online Pension Tracing Service on GOV.UK, making it faster and simpler for people to find a lost workplace or private pension. The free online service has had over 100,000 users since we began testing it in October 2015, helping many to trace their lost pensions.

Pension Wise, the Government’s free guidance service, has moved to the Department for Work and Pensions.

With today’s launch of the new State Pension, we’re starting to bring clarity to a system that few people truly understand.

Last autumn, I published a number of blog entries to help explain how the old system worked. Through this entry, which focusses on the period up to 5 April 2016, I want to show how people may have paid different amounts of NI over their working life through to the end of the tax year …

In previous blogs I have outlined the changes to the State Pension from 6 April 2016. There are a couple of ways you can check how these changes will affect your own position.

In October 2015, we launched the State Pension top up scheme, giving everyone reaching State Pension age before 6 April 2016, the chance to boost their long-term income by up to £25 a week.