We pay National Insurance (NI) contributions which means we qualify for certain benefits, including the State Pension.

This blog only focusses on the State Pension, but please bear in mind that NI contributions also qualify towards health, disability, unemployment and other benefits too.

There are different types of NI - known as ‘classes’.

The type you pay depends on your employment status and how much you earn. There are also special types of contributions you can make if you want to fill gaps in your NI record to help increase your State Pension.

It’s quite complicated and can be confusing.

This blog will just focus on how NI payments help you build up your State Pension. I hope it will give you a better idea of how the system works.

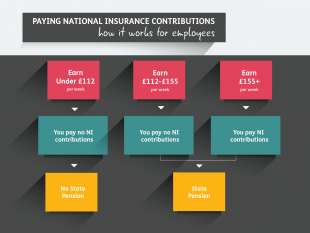

Paying National Insurance – how it works for employees

Earn over £155pw - you pay NI contributions. If you earn more than £155 a week (£8,060 a year) your employer will deduct money from your salary to pay for your National Insurance contribution and those contributions will count towards your National Insurance record for State Pension.

Earn £112 to £155 a week - you don’t actually pay NI contributions but are treated as if you did so it counts towards your NI record. If you earn more than £112 a week but less than £155 a week (annual salary of between £5,824 and £8,060) you don’t actually pay any National Insurance, but you will be treated as having paid contributions.

Your NI record will build up as if you have paid, which means that it will count towards your State Pension for that year.

Earn less than £112 a week – you don’t pay NI and your earnings won’t be recorded on your NI record. If you earn less than £112 a week (or £5,824 a year), you don’t pay any National Insurance and you won’t be building an NI record for the time you are working.

Click on image to enlarge.

Put another way, if you are working for less than around 18 hours a week at the National Minimum Wage (£6.50 an hour currently, £6.70 an hour from Oct 2015), none of your earnings will count towards your NI record or a future State Pension.

More complexities:

There are some other complexities to the system. If you earn at least £112 a week - £5,824 a year - in a single job, that year will count towards the State Pension.

However, if you have two jobs and earn £56 a week in each - which still amounts to £5,824 over the whole year - you can’t combine the two together for National Insurance purposes.

That means you won’t be treated as having paid National Insurance and won’t be building up your NI record for that year.

If you want to cover a gap in your contribution record for that period, you can pay Voluntary National Insurance contributions.

Self-employment

If you are self-employed you might have to pay two different classes of NI. This is because every self-employed person has to pay Class 2 NI contributions, except those with ‘small profits’.

The Class 2 contributions you pay count towards your State Pension. One Class 2 contribution is equal to one week’s earnings of at least £112 a week.

If you make £8,060 or more in profit, then you will also be liable for Class 4 NI contributions (but Class 4 contributions do not count towards your State Pension).

If your earnings and profits are too low, you can still pay National Insurance to protect your State Pension even though you don’t have to.

Building your National Insurance record even if you don’t pay NI - NI credits

If you are unable to work, or do not earn enough to pay or be treated as paying contributions, you might be entitled to National Insurance credits.

You can get credits to cover a number of different circumstances for instance, if you are caring for children, caring for adults, are too ill to work or are looking for work.

Credits can help you plug gaps in your NI record and will count towards the State Pension.

Credits can be combined with your paid National Insurance contributions to build up a qualifying year for State Pension purposes.

Voluntary NI contributions

You can also pay contributions on a voluntary basis to cover gaps in your NI record.

There are time limits on when you must do this and the later you pay voluntary contributions for a particular year, the more it may cost you to fill that gap in your record.

You can get a State Pension statement to help you decide whether to pay voluntary contributions.

It’s important to remember that paying extra NI contributions might not actually increase the amount of money you will receive from the State Pension system.

If in doubt, check it out first. You can find out more on our website, or contact The Pensions Advisory Service.

I have set out a summary of the different classes of NI contribution rates and how they build towards your State Pension in Table 1.

| Contribution | How it counts for State Pension | Rate (2015/16) |

| Class 1 Standard rate | Basic State Pension (BSP) and State Second Pension (S2P) | Employees pay: 12% on weekly earnings of £155 to £815 2% on weekly earnings over £815

Employers pay: 13.8% on weekly earnings over £156 (Lower rates for employees under age 21)

|

| Class 1D Contracted out rate for employees and employers | BSP (and S2P top-up if employee earns under £34,300pa) | Employees pay: 1.4% for earnings between £112 - £155pw 10.6% for earnings from £155.01 - £770.00 12% on earnings from £770.01 - £815pw 2% on earnings over £815pw

Employers pay: 3.4% on earnings from £112 - £156pw 10.4% on earnings from £156.01 - £770pw 13.8% on weekly earnings over £770 |

| Class 2 for self-employed | BSP | £2.80 a week |

| Class 3 Voluntary NI | BSP | £14.10 a week |

| Class 4 for self-employed | Doesn’t count for State Pension | 9% on annual profits of £8,060 to £42,385 2% on annual profits over £42,385 |

| Credits (for example, carers, people on incapacity or disability benefit or Employment and Support Allowance) | BSP and S2P (flat-rate part) | Equal to weekly earnings at the lower earnings limit (£112) |

From April 2016 onwards all classes of contributions and credits will count towards new State Pension entitlement.

My next blog: part two of Understanding the State Pension

I hope you found this interesting.

This section of Pensions Latest contains a series of blogs written by Ros Altmann the Minister for Pensions. They explain the existing State Pension system and how it changes with the introduction of the new State Pension for people reaching State Pension age from 6 April 2016. The blogs do not cover every circumstance and some of the descriptions used simplify what can be complex information. More detailed facts sheets can be found on gov.uk by searching for the new State Pension. We recommend that you get independent advice before making any financial decisions based on the information in the blogs. The blogs are written based on the position at December 2015.

2 comments

Comment by Anne Puckridge posted on

Whilst we appreciate the enormous amount of dedication and hard work that you have put into your blogs, it is immensely disappointing that nowhere is there any mention of resolving the injustice of frozen pensions, although you have always assured us you would do whatever you can, when you can.

Lady Ros, the opportunity to right the cruel injustice is here now but time is fast running out for many of us. Please don't abandon us!! All we ask for is what we were allowed to believe while paying our decades of NI contributions - adequate financial provision for our retirement, which has been stolen from us. To quote your own parents' advice, please "don’t stand by, stand up, stand strong" and restore integrity and its lost sense of justice to the British Government.

Comment by DWP Pensions Latest posted on

Annual increases are paid to eligible UK State Pension recipients living outside the UK where there is a legal requirement; for example, where UK State Pension recipients are living within the European Economic Area or where there is a reciprocal agreement between the UK and the host country that provides for uprating of the UK State Pension.

Upratings are currently paid to eligible UK State Pension recipients in the European Economic Area (EEA) and Switzerland under the provisions of the European Union's social security coordination legislation.

Under reciprocal agreements between the UK and the host country, upratings are also paid to eligible UK State Pension recipients living in the following countries: Barbados; Bermuda; Channel Islands; Isle of Man; Israel; Jamaica; Mauritius; the Philippines; Turkey; the United States of America and the now separate republics of the former Yugoslavia that are not EU Member States: Bosnia-Herzegovina; Kosovo; Montenegro; Serbia and the former Yugoslav Republic of Macedonia.

The issue of uprating has been the subject of debate in Parliament, most recently during the Lords Committee stage of the Pensions Bill on 8 January 2014 in the context of the new State Pension. Both Government and Opposition Peers acknowledged that changing the policy on up-rating could not be supported as a priority and would have significant cost implications. The issue has also been examined by the domestic courts, including the House of Lords and the European Court of Human Rights, and all legal decisions have found against the applicants.

Many other countries operate complex, means tested pension systems. Money spent on providing UK State Pensioners living in these countries with additional funds would mean at least part of these funds would be directed towards the Treasury of these countries rather than the pensioners.

The policy on uprating overseas pensions is a long-standing one and to increase rates of pension in countries where these are frozen would have significant costs – both short and long-term. The Government has made a collective decision with regard to overall spending plans when considering policy on the State Pension. There are no plans to change the current policy on uprating.