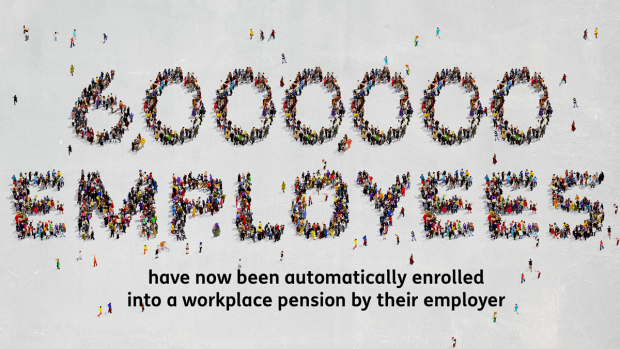

6 million employees are now enrolled into workplace pensions, thanks to Automatic Enrolment.

This is an important milestone as it means we’re two thirds of the way to reaching the expected 9 million employees who’ll be newly saving, or saving more as result of Automatic Enrolment by 2020.

More than 100,000 employers have now automatically enrolled their staff into a pension. Along with the country’s largest employers, thousands of small businesses and micro employers from scaffolding firms to children’s nurseries, hauliers to farmers, charities to car dealerships and people who employ a personal care assistant or a nanny have started paying into workplace pensions for their staff. Every employer must think about providing a pension and set up a scheme for their qualifying staff.

Don’t ignore it!

We recently launched the ‘Don’t ignore the Workplace Pension’ campaign featuring ‘Workie’– a giant character representing the workplace pension – to coincide with small and micro employers starting to enrol their staff. The campaign was designed to raise awareness of Automatic Enrolment and encourage employers to make sure they find out more about what they need to do.

Members of staff don’t have to do anything to be enrolled but the process is not automatic for employers - there are a number of things you’ll need to do. The Pensions Regulator has made it simpler than ever before for you to comply with the law and there are tools on their website to help you through the steps.

Helping employers comply with the law

If you’re a small employer and you haven’t begun the process yet, you can find out when you will need to start, by checking your staging date on The Pension Regulator’s website. This is the date your Automatic Enrolment duties come into effect. You need to be prepared for this date.

It’s important that you understand what you have to do and by when. This will depend on your circumstances and those of your staff. To work out what you need to do, when you need to do it, and to make sure you only complete the tasks relevant to you, please see the Duties Checker. By answering some simple interactive questions, you can find out if you need to put any staff into a pension scheme and, if so, the steps you’ll need to take. Any employees aged between 22 and State Pension age and earning more than £10,000 a year will need to be put into a pension scheme and you’ll have to contribute to it for them too.

Find out more

The latest figures show that the majority of employers are completing what they need to do on time and putting their staff into a pension. The vast majority of small employers have complied with the law. Automatic Enrolment can be set up by all, including the very smallest employers, using the tools on The Pension Regulator’s website. Please check what you need to do as soon as you can, so you are prepared. It is so important that we help all UK employers understand that being an employer means you must take responsibility for your employee’s National Insurance, tax - and pension too. That way, millions more people can start to look forward to a better later life.

If you’re an employer, find out more about your Automatic Enrolment duties at www.thepensionsregulator.gov.uk/en/employers.

If you’re an employee, find out more about workplace pensions and hear from some case studies at www.workplacepensions.gov.uk.