I want to try to help you understand how the State Pension works – both under today’s rules and in the future.

I will start by explaining the current State Pension – the system you pay National Insurance towards at the moment.

You are in the current system if you reach State Pension age before 6 April 2016.

You are in the new system if you reach State Pension age on or after 6 April 2016.

Even if you are in the new system, you will probably need to know about the current system and what State Pension you have built up so far.

Forgive me, but some of this is really, really complex so it won’t be easy to boil it down to utter simplicity.

But please bear with me if you want to know more about how the whole system operates, and understand how it affects you.

In this and subsequent blogs, you will begin to recognise the complexity of the current UK State Pension system.

The current rules have grown up over the years and we really have to simplify for younger generations.

Once you see how hard it is for me to help you understand how it works, you may have a better idea of why the system needed to change!

We will be moving to a new State Pension system from April 2016, but more of that in a future blog, let’s start with the here and now.

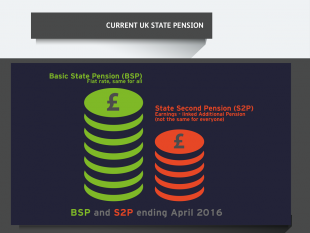

The current State Pension comes in two parts:

Click on image to enlarge

These two parts of the state pension are different.

The basic State Pension is a flat-rate amount and quite simple to work out.

The State Second Pension (S2P) comes in two parts and depends on how much you have earned while working and what kind of National Insurance you have paid or been credited. It is much more complicated.

National Insurance contributions you are making today can build up both your basic State Pension and S2P.

Click on image to enlarge

Let’s start with the basic State Pension

Your National Insurance contributions or credits each year count towards the basic State Pension (unless you are one of the few people still paying reduced rate married woman’s stamp).

If you are on low earnings - earning between £112 a week and £155 a week - you are treated as paying NI contributions even though you don’t. This still counts on your National Insurance record for State Pension.

State Second Pension – S2P

If you:

- pay National Insurance contributions as an employee

- are not paying the lower “contracted-out” NI rate (see more on this later)

- are ‘contracted out’ but earning under £34,300 a year (more on this later)

- are not self-employed

then you will be paying towards S2P as well as Basic State Pension.

Many National Insurance credits you are entitled to (for example, if you are a carer or disabled) can also count towards part of S2P as well.

How much basic State Pension will I get?

Working out this first part of the State Pension is the simplest.

The amount of basic State Pension you build up for each year on your NI record is the same regardless of your earnings, so it is quite easy to understand.

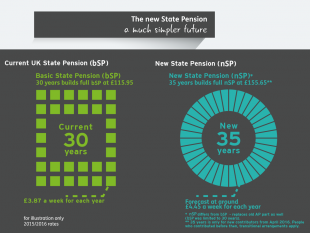

Full basic State Pension = £115.95 a week

The full basic State Pension is worth £115.95 a week at the moment (it changes each April) and you need 30 years on your NI record to qualify for this full rate.

Each year of National Insurance contributions will give you 1/30th of the full Basic State Pension, up to the full rate. In other words, every year gives you around £3.87 a week of Basic State Pension – in today’s money (£115.95 ÷ 30 = £3.87).

Click on image to enlarge

For example, if you have 25 years on your National Insurance record at the moment (unless you paid reduced rate Married Woman’s contributions), you will have 25/30ths of the full rate. This would give you 25 x 1/30th of £115.95, which works out at £96.62 a week of Basic State Pension.

What about the S2P Additional State Pension – how much of that will I get?

I’m afraid the amount of S2P you get is rather more complicated to calculate. It depends on your earnings and whether you are “contracted out” (more about this later in another blog).

S2P comes in two parts:

- a flat rate amount

- an earnings- related amount (for those who earn over £15,300 a year)

Click on image to enlarge

Let’s start with the flat rate part. If you earn over £112 a week (£5,824 a year) and contribute full National Insurance at the standard rate, you will build up £1.80 a week of S2P.

If you earn over £15,300 a year, you will also build up some earnings-linked S2P in addition to the £1.80 a week flat-rate part.

The amount you get is worked out by a complicated formula and increases with your earnings up to a maximum of £40,040 a year. (If your earnings are above £40,040 a year, your earnings-related S2P will be the same as if you earned £40,040).

So here is that complicated formula if you want to know how it works:

Take 10% of your earnings between £15,301 and £40,040

- Divide this by 44 (our definition of the years in a working life)

- Divide this by 52 to find the weekly amount.

It may help if I give you an example of how to calculate the amount of S2P you build up:

If you earn £25,000 a year, you will be building up the flat rate £1.80 a week of S2P and some earnings-related S2P to add to that, in line with the formula:

The amount you earn above £15,300 = £25,000 - £15,301 = £9,699

Take 10% of this: £9,699 ÷ 10 = £969.90

Divide this by 44: £969.90 ÷ 44 = £22.04

Divide this by 52: £22.04 ÷ 52 = £0.42

So, in addition to the £1.80 flat rate amount of S2P you will also have an extra 42p a week giving a total S2P building up for the year of £2.22 a week in S2P. This gives you an extra £2.22 a week from your State Pension Age for the year you contributed fully to S2P.

If you are earning £25,000 a year, and paying National Insurance you will also be building up your Basic State Pension as well. So you build up £3.87 of Basic State Pension, as well as the £2.22 of Second State Pension, giving a total of £6.09 a week of future State Pension building up for that year.

As you can see from this example, it is really hard to work out how much State Pension you are building each year. Particularly because of the complexity of S2P and its different qualifying credits or earnings levels. Today’s State Pension system is the result of many years of piecemeal reform, with lots of extra complexities being added along the way. The Government recognises that things have become far too complicated.

This is why we are moving to a new system from April 2016 – known as the ‘new State Pension’. Having a flat-rate system with just one single part, the same for all, will be easier to understand. That’s the aim for the future.

But before I tell you more about this new system, there is still another complex part of the current State Pension than you need to understand. In fact, it is the most complicated piece of all – it’s known as ‘contracting out’, this will be the subject of my next blog as it’s important for you to understand what this is all about before I go into more detail about the new State Pension itself.

I hope this has helped to explain the current State Pension system. Please do leave your comments on whether you found it useful.

This section of Pensions Latest contains a series of blogs written by Baroness Ros Altmann the Minister for Pensions. They explain the existing State Pension system and how it changes with the introduction of the new State Pension for people reaching State Pension age from 6 April 2016. The blogs do not cover every circumstance and some of the descriptions used simplify what can be complex information. More detailed facts sheets can be found on gov.uk by searching for the new State Pension. We recommend that you get independent advice before making any financial decisions based on the information in the blogs. The blogs are written based on the position at December 2015.

2 comments

Comment by Jane Davies posted on

Please will you say something about the frozen state pensioners, they are never mentioned, is this because of the shame that this scandal causes? When is the government going to end this injustice?

Comment by DWP Pensions Latest posted on

Annual increases are paid to eligible UK State Pension recipients living outside the UK where there is a legal requirement; for example, where UK State Pension recipients are living within the European Economic Area or where there is a reciprocal agreement between the UK and the host country that provides for uprating of the UK State Pension.

Upratings are currently paid to eligible UK State Pension recipients in the European Economic Area (EEA) and Switzerland under the provisions of the European Union's social security coordination legislation.

Under reciprocal agreements between the UK and the host country, upratings are also paid to eligible UK State Pension recipients living in the following countries: Barbados; Bermuda; Channel Islands; Isle of Man; Israel; Jamaica; Mauritius; the Philippines; Turkey; the United States of America and the now separate republics of the former Yugoslavia that are not EU Member States: Bosnia-Herzegovina; Kosovo; Montenegro; Serbia and the former Yugoslav Republic of Macedonia.

The issue of uprating has been the subject of debate in Parliament, most recently during the Lords Committee stage of the Pensions Bill on 8 January 2014 in the context of the new State Pension. Both Government and Opposition Peers acknowledged that changing the policy on up-rating could not be supported as a priority and would have significant cost implications. The issue has also been examined by the domestic courts, including the House of Lords and the European Court of Human Rights, and all legal decisions have found against the applicants.

Many other countries operate complex, means tested pension systems. Money spent on providing UK State Pensioners living in these countries with additional funds would mean at least part of these funds would be directed towards the Treasury of these countries rather than the pensioners.

The policy on uprating overseas pensions is a long-standing one and to increase rates of pension in countries where these are frozen would have significant costs – both short and long-term. The Government has made a collective decision with regard to overall spending plans when considering policy on the State Pension. There are no plans to change the current policy on uprating.