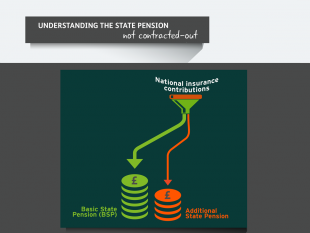

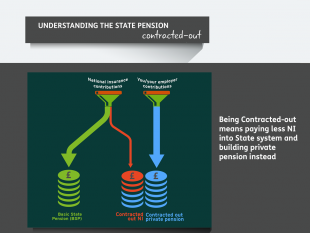

Being “contracted-out” generally means that you are paying lower National Insurance rates than the standard full rate for employees.

You will be paying lower National Insurance as you are opted out of State Second Pension (S2P). Your employer pays lower National Insurance too.

You can only be contracted-out if you are building up another pension that is at least as good as the S2P you would have received from the State. The idea is that some of your private employer pension will replace the S2P you would have built up if you were paying the full rate of National Insurance.

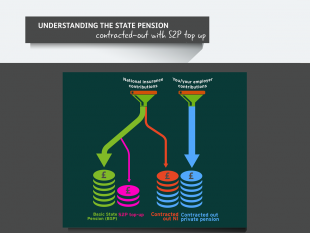

If you earn under £34,300 a year, you are also building up some S2P from the state – known as ‘S2P top-up’, in addition to your private pension.

So contracting-out means being part of a pension scheme that allows you to pay lower National Insurance to the State and build up an alternative pension instead of S2P.

You cannot opt out of the basic State Pension - you will still qualify for that in the normal way, even if you are contracted-out.

So who is contracted-out?

Since 2012, you can only be contracted-out of S2P if you belong to an employer pension scheme that promises you a specified amount of pension. These are called ‘Defined Benefit’ pensions and include final salary schemes or career average schemes.

If you work in the public sector, you are likely to be contracted-out. For example, teachers, NHS workers, civil servants, local government staff and police are all contracted-out and paying reduced National Insurance rates as a result.

While fewer people employed in the private sector are contracted-out today, in the past many private sector workers were.

Click on image to enlarge

How do I know if I am paying lower National Insurance because I’m contracted-out?

You probably don’t! Most people do not know how much National Insurance they should be paying or how their National Insurance is worked out. It is just a deduction from their pay and their employer works it out for them.

If you are paying less National Insurance than someone working elsewhere who is on the same salary as you, you probably won’t realise.

In fact, you could be saving quite a bit of money each year relative to someone on the same salary as you who is not in a contracted-out pension scheme.

The contracted-out rate of National Insurance for employees is 10.6% (whereas the standard rate is 12%).

If you are contracted-out, your employer also pays a lower National Insurance rate (they pay 10.4% instead of the standard 13.8% rate).

Examples of the amounts of National Insurance paid by those contracted-out and not contracted-out are shown in the tables below:

Employee rates of National Insurance

| Annual earnings | Amount of NI paid per year if contracted out | Amount of NI paid per year if not contracted out | Difference |

| £15,000 | £702.00 | £829.82 | £127.82 |

| £25,000 | £1760.20 | £2028.00 | £267.80 |

| £50,000 | £3791.32 | £4270.24 | £478.92 |

Employer rates of NI – contracted out and not contracted out

| Annual earnings of employee | NI paid by employer if employees contracted out | NI paid by employer if employees not contracted out | Difference

(Amount saved on NI each year) |

| £15,000 | £ 638.96 | £950.46 | £311.50 |

| £25,000 | £1678.56 | £2330.48 | £651.92 |

| £50,000 | £4617.20 | £5780.55 | £ 1163.35 |

How does being contracted-out affect my National Insurance State Pension?

Being contracted out now means you have been opted out of most of the State Second Pension for the duration of the time you are contracted-out. Instead you are building a replacement for this in your employer scheme. You are allowed to pay a reduced National Insurance rate to reflect the fact that you are opting out of State Second Pension and building another pension instead, which offers a pension which should be at least as good as the State Second Pension you would have received - and usually it will actually be more generous than that.

Click on image to enlarge

People who are contracted out and earn less than £34,300 do still build up a bit of S2P as well as their private pension.

There is another complication. If you are contracted out this year and earn under £34,300 a year, you will still get a little bit of Second to add to your basic State Pension.

In other words, if you earn less than £34,300 this year, you will get a “top up” to your S2P, in addition to whatever you are putting aside in your employer pension scheme.

So if you are contracted-out this year and earning less than £34,300, your State Pension building up is as follows:

State Pension = basic State Pension + State Second Pension "top up"

Click on image to enlarge

This section of Pensions Latest contains a series of blogs written by Baroness Ros Altmann the Minister for Pensions. They explain the existing State Pension system and how it changes with the introduction of the new State Pension for people reaching State Pension age from 6 April 2016. The blogs do not cover every circumstance and some of the descriptions used simplify what can be complex information. More detailed facts sheets can be found on gov.uk by searching for the new State Pension. We recommend that you get independent advice before making any financial decisions based on the information in the blogs. The blogs are written based on the position at December 2015.

10 comments

Comment by David Woodcock posted on

It seems that the calculations of the 'value' built up by being opted out far exceeds the 'value' of being opted in. My statements seem to show that the penalty (reduction) for the years of being opted out is huge compared to the value (benefit) of the years being opted in.

It's far from clear on what basis the calculations are done.

Is it explained anywhere ?

Comment by DWP Pensions Latest posted on

People who have been contracted-out of the State Pension under the current rules will, in the majority of cases, benefit under the new State Pension.

The current State Pension is made up of two parts: the basic State Pension; and the earnings-related additional State Pension. If you are currently or have been part of an earnings-related workplace pension (such as a final salary, career average or Defined Benefit pension), you’re likely to have been ‘contracted-out’ of the additional State Pension. Before April 2012, you could also have been contracted-out into a scheme that is not earnings-related (called a Defined Contribution or Money Purchase scheme), including a personal pension scheme.

During this time, you and your employer will have paid a lower rate of National Insurance (NI) contributions, instead investing in your workplace pension, or else a portion of your NI was paid into your personal pension.

Being contracted-out means you were opted out of the earnings-related additional State Pension. This means you will have been building little or no additional State Pension during this period, but will have been building some private (workplace or personal) pension instead of the additional State Pension that you and your employer’s NI contributions would otherwise have provided. Your private pension should include an amount of pension which will in most cases be the equivalent of the additional State Pension you would have been paid if you had not been contracted-out. Most people reaching State Pension age in the first couple of decades of the new State Pension will have been contracted-out at some point in the past.

To determine a person’s new State Pension, a ‘Starting Amount’ calculation is made. The calculation compares what their NI record as of April 2016 would provide as a State Pension under both the current State Pension rules and under the new State Pension rules. Both calculations take account of past periods of contracted-out employment. Whichever is the higher of these figures becomes their ‘Starting Amount’ for the new State Pension and will form the base on which, in most cases, they may be able to add to their State Pension under the new system in the future.

If you have been contracted-out for the majority of your working life, it is highly likely that your Starting Amount will be greater under the current State Pension rules. So that is the amount you will start with in the new State Pension system. But of course, if you have been contracted-out, your private pension scheme normally would pay a pension which is at least the same amount as the additional State Pension you would have got if you hadn’t been contracted-out. So whilst your Starting Amount may be less than the full new State Pension, you could actually have built up more than the full amount if you add your State Pension and private pension together.

Importantly, you may also be able to add to your Starting Amount after April 2016, until you reach either State Pension age, or you have reached the full weekly amount. This would happen by adding qualifying years to your NI record, for example through paying NI contributions through work or receiving NI credits. Each qualifying year will add 1/35th of the full weekly rate of new State Pension to your Starting Amount (£4.45 in 2016/17) until you reach the full amount or State Pension age.

As an example, if you have 30 years of NI contributions and have always been contracted-out, you would get a Starting Amount of £119.30 a week in April 2016. This is because the higher calculation figure is based on the old rules and you would get the equivalent of the full amount of basic State Pension. In other words, based on 2016/17 rates, no more than £36.35 a week will be deducted (£155.65 - £119.30 = £36.35) from the full rate of new State Pension if you have at least a 30 year NI record, even though the value of private pension you built whilst contracted-out could be higher than this. If you work for a further 9 years, you will reach the full amount of new State Pension (the equivalent of £155.65 a week in 2016/17) because you will have added 9 years’ worth of 1/35th of the full amount to your Starting Amount.

You can find out more about what it means to have been contracted-out of the additional State Pension at http://www.gov.uk/additional-state-pension/contracting-out

Comment by P O'Brien posted on

I shall be grateful if you will confirm what will happen in the following circumstance;

A person has;

27 years 'contracted out' between 1978 & 2004. (ie no additional state pension)

11 years contracted in S2P - (say £25 S2P)

Will this person be able to build up New State Pension £4.45 for 9 years up to the maximum of £36.35?

Or will the S2P earned restrict the amount of New state Pension the person can earn?

Many thanks

Comment by DWP Pensions Latest posted on

Whilst we don’t respond to individual queries on these blogs, further information about contracting-out is available at http://www.gov.uk/government/publications/new-state-pension-if-youve-been-contracted-out-of-additional-state-pension. You can also get a forecast of the State Pension you may get at State Pension age, and details of how you may be able to increase this, via our new Check your State Pension service at http://www.tax.service.gov.uk/checkmystatepension.

Comment by Mark posted on

The person in the worked example above is able to build up, and benefit from 39 years of NI contributions. I had assumed the new state pension had a maximum contribution benefit limit of 35 years - in the same way the current basic pension has a contribution benefit limit of 30 years.

The worked example suggests this is in fact not the case and that the new state pension is not capped at 35 years for someone transitioning from the current system, who due to contracting out, who finds themselves below the new state pension amount when they complete 35 years of contributions.

Is that correct?

Comment by DWP Pensions Latest posted on

Yes, this is correct. Under the transitional rules, customers can continue to add qualifying years to their NI record from 6 April 2016. Each qualifying year after that date can increase their State Pension by 1/35th of the full amount of new State Pension, until they reach either the full amount of £155.65 (2016/17 rate) or their State Pension age, whichever occurs first. You can find out more about contracting-out and the new State Pension at http://www.gov.uk/additional-state-pension/contracting-out.

Comment by Jeff posted on

I am already in receipt of my contracted out workplace pension. When I reach state pension age, will COPE be added to my existing pension or am I already being paid the COPE?

Comment by DWP Pensions Latest posted on

When you reach your scheme’s retirement age, you should normally have an amount equivalent to the COPE included in your scheme pension as part of your benefits from your workplace scheme. This is the amount that is expected to replace the State Pension that you were opted out of when you paid the lower rate of contracted-out National Insurance to the State Pension system. You can find out more about the COPE at http://www.gov.uk/government/publications/state-pension-fact-sheets/contracting-out-and-why-we-may-have-included-a-contracted-out-pension-equivalent-cope-amount-when-you-used-the-online-service.

Comment by John Cawson posted on

I have been trying to find out the answer to your question as well, no one seems willing or able to give a definitive reply, in my case it relates to a police pension which I have contributed 11% of my salary for 30 years.

Comment by DWP Pensions Latest posted on

Thanks for your comment, John. Whilst we don’t respond to individual queries on these blogs, you can get a forecast of the State Pension you may get at State Pension age, and details of how you may be able to increase this, via our new Check your State Pension service at http://www.tax.service.gov.uk/checkmystatepension. You can also find out more about contracting-out at http://www.gov.uk/government/publications/new-state-pension-if-youve-been-contracted-out-of-additional-state-pension.