So far, I’ve just explained how your State Pension builds up at the moment, based on National Insurance (NI) you are paying or credited with this year. But your eventual State Pension will depend on your past National Insurance record, as well as what you are building right now. In order to help you understand the full picture for your State Pension, you need to know about the changes that have happened to the State Pension over time. This blog explains how the main parts of the State Pension have changed over the years.

Successive Governments have made many changes to the State Pension. Each time the rules changed, you started building a new type of State Pension, on top of the type of State Pension you had already built from your previous NI record. So you need to understand all the different parts you have been part of (and also know how much you earned in each of the years if you were working), in order to find out how much you will receive when you reach your State Pension Age.

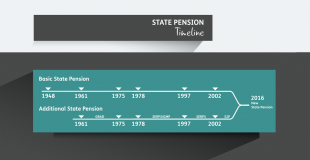

The basic State Pension has not changed much since 1948, remaining a flat-rate amount, although the number of qualifying years for a full basic State Pension has been adjusted.

However, the earnings-related part of the State Pension (the Additional State Pension) has changed several times.

The timeline below shows the changes to the Additional State Pension, which mean you could have built up one, two or three different types. Depending on the year in which you made NI contributions, you could have paid towards the following:

- 1961 - 1975: Graduated Retirement Benefit (Grad);

- 1978 - 2002: State Earnings Related Pension Scheme (SERPS);

- 2002 – 2016: State Second Pension (S2P).

Click on image to enlarge

So, in the past, you could have built up an Additional State Pension that consists of up to three different bits

Additional State Pension = Grad + SERPS + S2P

Calculating your State Pension under the old system

When working out your State Pension, we will look at the National Insurance that you paid in the past and which part of the State Pension you were building at that time. The amount of State Pension you have built up in the past depends on

- what type of National Insurance you paid or credits you received

- which year you paid or were credited into National Insurance

- how much you earned in each year

The maximum amount of State Pension you could have built up over the years would consist of:

Total State Pension = Basic State Pension + Grad + SERPS + S2P

However, this assumes that you were never contracted out of the Additional State Pensions (SERPS or S2P) in the past. If you were contracted out of SERPS or S2P in some or all of these years, then the calculation would be different (for information on contracting out see blog 3 in this series). I will explain more about this in the next blog: How contracting out affects the calculation of your State Pension.

This section of Pensions Latest contains a series of blogs written by Baroness Ros Altmann the Minister for Pensions. They explain the existing State Pension system and how it changes with the introduction of the new State Pension for people reaching State Pension age from 6 April 2016. The blogs do not cover every circumstance and some of the descriptions used simplify what can be complex information. More detailed facts sheets can be found on gov.uk by searching for the new State Pension. We recommend that you get independent advice before making any financial decisions based on the information in the blogs. The blogs are written based on the position at December 2015.