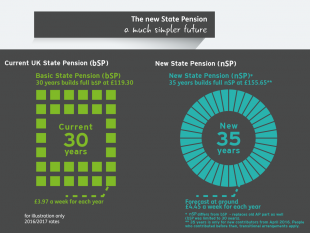

People who start work after April 2016 will have the benefit of a much simpler State Pension system.

Click on image to enlarge

Many of the complexities that exist with the current system will, over time, be consigned to history.

The idea of basic and additional elements of the State Pension will disappear and there will no more contracting-out. Instead, everyone will pay National Insurance contributions at the same rate.

Of course, we can’t just change things overnight. Because people have paid different amounts of the past years and decades, it would be very unfair to wipe that all out and start from scratch. But, over time, the State Pension will become much easier to understand.

For millennium babies – people who start work after April 2016 – things are very straightforward. They will need 35 years’ worth of National Insurance to get a full State Pension, and will accumulate 1/35th of that amount for every year they work (or get NI credits).

For the rest of us, the legacy of the past means things will continue to be a bit more complicated. Rest assured though, our utmost priority is to make sure the system treats everybody fairly and gets the State Pension they entitled to.

This section of Pensions Latest contains a series of blogs written by Baroness Ros Altmann the Minister for Pensions. They explain the existing State Pension system and how it changes with the introduction of the new State Pension for people reaching State Pension age from 6 April 2016. The blogs do not cover every circumstance and some of the descriptions used simplify what can be complex information. More detailed facts sheets can be found on gov.uk by searching for the new State Pension. We recommend that you get independent advice before making any financial decisions based on the information in the blogs. The blogs are written based on the position at December 2015.

6 comments

Comment by Kenneth posted on

She is correct in stating "People who start work after April 2016 will have the benefit of a much simpler State Pension system." but fails to mention that it will be between two to three thousand pounds less than they would have received under the current state pension system and their will no longer be inheritance rights.

Comment by DWP Pensions Latest posted on

The new State Pension for people reaching State Pension age on or after 6 April 2016 will be an individual pension, meaning qualification will be based on a person’s own National Insurance contributions.

In general, there will no longer be provision for a person to use their spouse or civil partner’s contributions to increase their State Pension or qualify for a State Pension.

The arrangements for deriving a State Pension date from the 1940s, and reflected the expectation common at that time that most married women would stop working once they started a family. Furthermore, before 1978, there was nothing in place to protect a woman’s State Pension while she was at home caring for children or a disabled relative. Much has changed since then, and this is demonstrated by the fact that the majority of women reaching State Pension age today have enough paid or credited contributions to qualify for a State Pension in their own right without needing to claim on their partner’s record.

Ending these provisions is only one part of the redesign of the State Pension which is intended to remove much of the existing complexity to provide a simpler scheme that people can understand. In introducing such a major reform without spending more on the State Pension overall, the Government had some difficult choices to make. While some people who have traditionally done less well under the existing system will gain, there will be others who may get a lower State Pension under the reforms than they were expecting.

We have, therefore, provided transitional protection of the derived basic pension for certain women who were not building up any State Pension of their own because, although they were working, they were paying married woman’s and widow’s reduced-rate National Insurance contributions.

We have also put transitional arrangements in place for people who are widowed. These recognise that in the current system part (or in some cases all) of a person’s additional State Pension – known as SERPS or State Second Pension - can be paid to their surviving spouse or civil partner. These arrangements will apply to people whose marriage or civil partnership began before the new State Pension starts. The level of protection will depend on whether their spouse or civil partner was in the current or the new State Pension system.

Comment by Pat strong posted on

Why transitional arrangements for existing pensioners, then nothing for newly widowed after April 2016? Ridiculous and It's not fair. Inherited SERPS is an historically accrued right, you can't just take it away without telling people. Where is our 10 year notice? Disgusted with your reforms and the way the dwp are handling the communications.

Comment by DWP Pensions Latest posted on

The new State Pension for people reaching State Pension age on or after 6 April 2016 will be an individual pension, meaning qualification will be based on a person’s own National Insurance contributions.

In general, there will no longer be provision for a person to use their spouse or civil partner’s contributions to increase their State Pension or qualify for a State Pension.

The arrangements for deriving a State Pension date from the 1940s, and reflected the expectation common at that time that most married women would stop working once they started a family. Furthermore, before 1978, there was nothing in place to protect a woman’s State Pension while she was at home caring for children or a disabled relative. Much has changed since then, and this is demonstrated by the fact that the majority of women reaching State Pension age today have enough paid or credited contributions to qualify for a State Pension in their own right without needing to claim on their partner’s record.

Ending these provisions is only one part of the redesign of the State Pension which is intended to remove much of the existing complexity to provide a simpler scheme that people can understand. In introducing such a major reform without spending more on the State Pension overall, the Government had some difficult choices to make. While some people who have traditionally done less well under the existing system will gain, there will be others who may get a lower State Pension under the reforms than they were expecting.

We have, therefore, provided transitional protection of the derived basic pension for certain women who were not building up any State Pension of their own because, although they were working, they were paying married woman’s and widow’s reduced-rate National Insurance contributions.

We have also put transitional arrangements in place for people who are widowed. These recognise that in the current system part (or in some cases all) of a person’s additional State Pension – known as SERPS or State Second Pension - can be paid to their surviving spouse or civil partner. These arrangements will apply to people whose marriage or civil partnership began before the new State Pension starts. The level of protection will depend on whether their spouse or civil partner was in the current or the new State Pension system.

Comment by Kenneth posted on

Why do you show the full NI only purchasing £115.95 when it is also purchasing up to about a maximum £160 additional state pension under the existing system which when added to makes the maximum state pension at the moment about £276 pw which is much higher than the new state pension of £ 151.25 pw.

You seem to choose your figures to make the new state pension is more generous than the existing state pension system which it is not.

Comment by Stephen Kenny posted on

I notice there is no mention that the New State Pension results in indexation of Guaranteed Minimum Pensions currently paid with state pension will stop for those with state pension age of 6/4/16 or later.

This has been calculated by actuaries (Mercer) as costing the person around £20,000 (male) to £23,000 (female) - a substantial sum.

GMP's are historical accruals relating to 1978 to 1997 and nothing to do with any future benefits from the New State Pension.

The DWP should as a minimum public ally acknowledge what the impact of the NSP is for those with GMP's something they have not done so far.